Land transfer tax rates in Ontario – Updated in 2017

The Ontario land transfer tax (LTT) is a marginal tax and each portion of your home’s value is taxed at a unique rate. These tax rates are as follows:

If you are purchasing a home in Toronto, it is important to note that an additional Toronto Land Transfer Tax will also apply. Beyond the land transfer tax you will also have to pay closing costs in Ontario when purchasing a home. These closing costs could include fees for an Ontario real estate lawyer and other buyer's fees.

Ontario land transfer tax rebate in Ontario

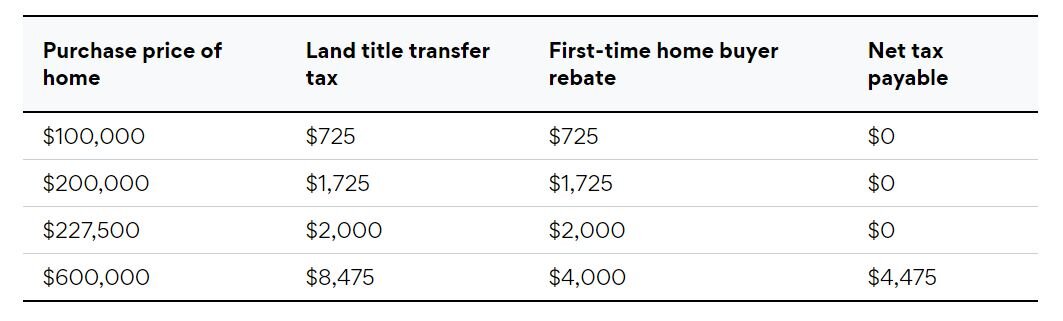

For first time home buyers, there is a maximum $4,000 tax rebate on the Ontario land transfer tax. Based on Ontario’s land transfer tax rates, this refund will cover the full tax for homes up to $368,333. For homes purchased for more than $368,333, buyers will receive the full $4,000 rebate and pay the remaining LTT balance.

For Example:

First-time home buyer eligibility in Ontario

You must be a Canadian citizen or permanent resident of Canada.

You must be 18 years or older.

You must occupy the home within 9 months of purchase.

You cannot have owned a home or interest in a home anywhere in the world.

Your spouse cannot have owned a home while being your spouse (but may be a previous home owner).

If the home is newly constructed, it must be eligible for home warranty.

Home buyers must apply for the refund within 18 months of purchase.

Application

Taxpayers can claim an immediate refund when registering the land transfer papers and paying their taxes. Tax rebate application forms are available online for home buyers registering electronically or on paper at government offices.

If the rebate is not claimed at the time of registration, the full tax is paid and a refund claim can be made to the Ministry of Finance within 18 months. Information required for the application include:

A completed Ontario Land Transfer Tax Refund Affidavit for First-Time Purchasers of Eligible homes.

A copy of the registered land transfer deed.

A copy of the agreement of purchase and sale

A copy of a document that provides proof of residence, such as a driver’s license, telephone/cable bills, etc.

Toronto land transfer tax map

The Toronto land transfer tax is charged to buyers who purchase homes in the following area:

Land transfer tax rates in Toronto – Updated August 2017

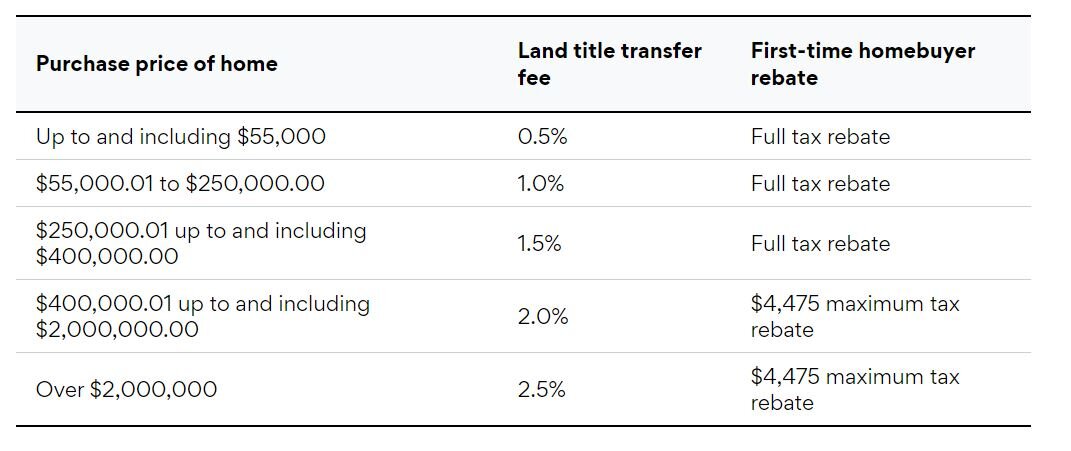

The cost of your land transfer tax (LTT) is a percentage of your home’s value, estimated using the property’s purchase price. Note that the LTT is not just a simple average tax of your home’s value. Instead, the LTT is a marginal tax and each portion of your house’s value is taxed at its own marginal tax rate. Buyers of real estate in Toronto must pay both the provincial land transfer tax (above) and municipal land transfer tax, as outlined below.

The rates above apply to all homes within the boundaries of Toronto. Specifically, the homes south of Steeles Avenue, east of Etobicoke, west of Scarborough and north of Lake Ontario. The land transfer tax applies whether you're buying a Toronto townhouse, house or condo.

Land transfer tax rebates in Toronto

For first-time homebuyers in Toronto, there is also a maximum $4,475 tax rebate on the municipal LTT. Based on Toronto’s tax rate, the rebate will cover the full Toronto LTT on homes worth $400,000 or less. The Toronto LTT rebate is calculated similarly to that of Ontario’s.

Eligibility for Toronto land transfer tax rebate

You must be a Canadian citizen or permanent resident of Canada.

You must be 18 years or older.

You must occupy the home within 9 months of purchase.

Your spouse cannot have owned a home while being your spouse (but may be a previous homeowner).

If the home is newly constructed, it must be eligible for home warranty.

Homebuyers must apply for the refund within 18 months of purchase.